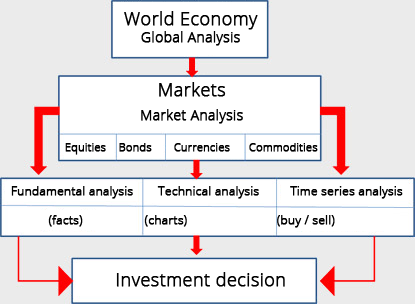

Holistic Analyses

From the big picture to a single stock in time cycles

Mutual dependence between real economies and financial markets, and correlation among individual asset classes, coupled with time cycle analysis, ensures the right decision at the right time.

The world revolves around itself and at Zwermann Financial we zoom in on the key economic and financial developments worldwide. Studying the world’s economic conditions is a prerequisite for making judgments about individual market movements.

Only holistic, global analyses make full sense. Which countries offer the best conditions? Which currencies have the best potential or the highest risk? How strongly do commodities and currencies affect the stock markets? Where do interest rates bolster currencies without slowing down the economy?

Time cycle analysis (course-of-events analysis) does not just help decipher market highs and lows, but also reveals possible movements over time, that is pre-determined entry and exit dates over the course of a year. The combination of economic, technical and time cycle analysis can provide more than mere assistance in making the right investment decision.

Fundamental analysis:

... the big picture: global environment, world politics, fiscal policy, monetary policy, worldwide economic situation

Technical analysis:

Market conditions

Correlation between asset classes

Special feature: time cycle analysis

Time cycle analysis:

Market development forecasts

Highs and lows at certain points in time